Owen Sound 's Housing Problem

property taxes make a bad situation worse

The Problem

There is no question we are facing a crisis in housing and homelessness throughout Ontario. Housing affordability is a reality facing many families. Some are forced to rent inadequate accommodations that just don 't meet their family needs while those dreaming of home ownership are just priced out of the market. Canadian Urban Institute 's report released in 2019 cited the housing supply as the main cause of the housing crisis. This was echoed by Ontario 's Affordability Task Force Report in 2022. However, in many areas, Owen Sound for example, housing supply is not the only driving force.

|

The housing and homelessness crisis in Ontario continues to be a serious and widespread issue. Finding a place to live in Ontario is a struggle for many due to low vacancy rates, limited supply, and an insufficient mix of housing options. The costs of ownership and rental rates are rising much faster than incomes, and people experiencing homelessness are in desperate need of a roof over their heads. Association of Municipalities Ontario |

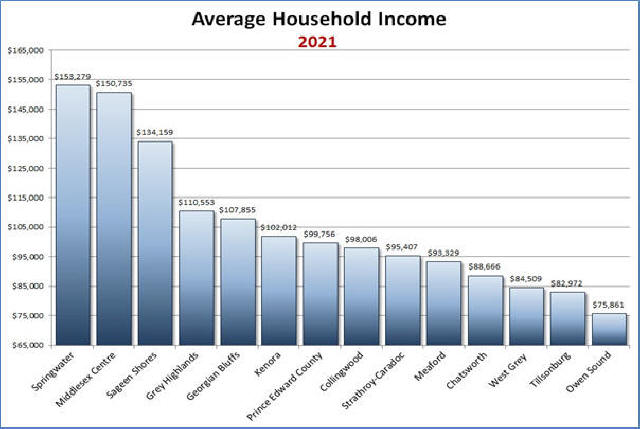

Wages in general are just not keeping up with the cost of housing in most communities. However, in communities like Owen Sound low household incomes coupled with rising costs make it particularly difficult for families. Owen Sound has one of the lowest average household incomes in the province at $75,861, which makes even small cost increases nearly unbearable for many families.

|

| Figure 1; Average Household Income source: BMA Municipal Studies |

It 's important to realize the significance of Owen Sound 's low household incomes. Most households have at least two wage earners which means that the average wage earner is taking home a gross income of about $38,000 which works out to be about $19 per hour. This is the average; which means that there are many families with household incomes of less than $75,861. In fact, when we look at the median (the middle), after-tax household income in Owen Sound we see that over half of the households in Owen Sound take home less than $57,600.

Affordable Housing

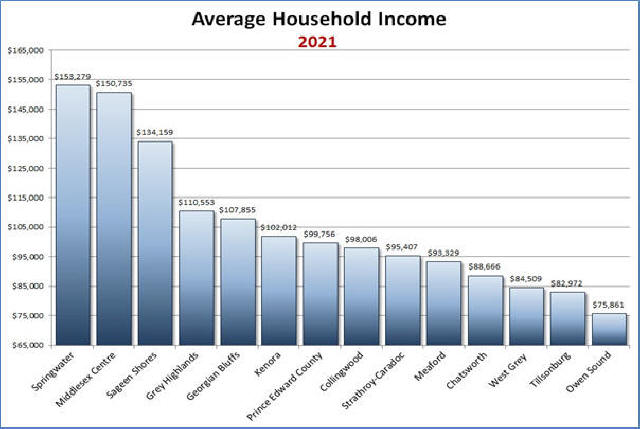

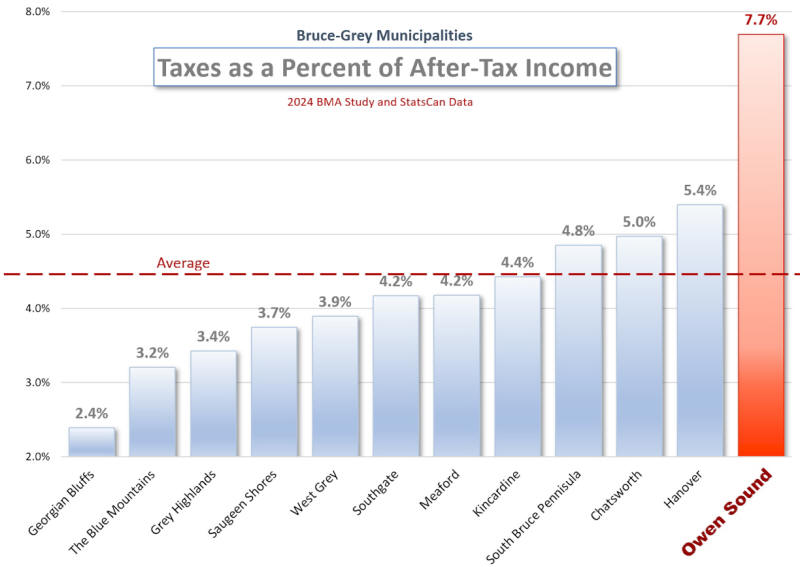

In Canada, housing is considered “affordable” if it costs less than 30% of a household 's before-tax income. If we take 30% of the household incomes from the 2022 BMA Report and divide 12 to get the gross monthly income for similarly sized urban municipalities, we get the results shown below in Figure 2.

|

| Figure 2; 30% of Gross Monthly Household Income source 2022 BMA Report |

This informs us that in Owen Sound the average family can afford to spend $1,892 per month on rent or on combined mortgage and property tax. The problem for renters is that a two-bedroom apartment in Owen Sound cost $1,735 and $2,035. This means that families with the average household income will have difficulty in finding affordable housing in Owen Sound.

For families in this situation even small increases in the cost of essentials such as food or rent become very significant. Landlords routinely pass on increases in property taxes to tenants in the form of rent increases, such as those that have been imposed annually over the last 30 years. Therefore an increase in property taxes can result in families, both homeowners and renters, paying more than 30% of their gross household incomes on housing.

Impact of Property Taxes

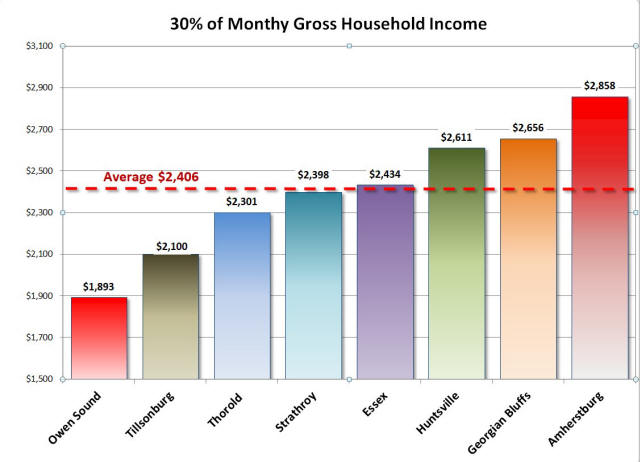

In order to do a fair comparison among municipalities when it comes

to taxes you really need to measure the ability for the ratepayer to

come up with the money to pay their taxes. In other words the real

impact that taxes have on the resident. Statistics

Canada tells us that the median household after-tax income for Owen

Sound is $57,600. The 2025 BMA Report gives us the property taxes on the average detached bungalow

for the municipalities in our area. When we calculate the

ratio of monthly property taxes to the monthly after tax income

using the average household income we get graph should below showing

what percent of after tax income that people have to pay in property

taxes.

The graph above shows the taxes on a single bungalow as a percentage

of median, after-tax household income. According to Statistics

Canada, Owen Sound has the lowest household after-tax income in

Bruce-Grey. The Owen Sound taxpayer spends 7.7% of their after-tax

income on taxes; while the average taxpayer in our area spends only

4.4% of their income. This speaks volumes about the financial

well-being of Owen Sound families - all families, since landlords

pass on taxes in the form of rent increases. In other words Owen

Sound taxpayers are unfairly burdened by taxes as compared to

taxpayers in our adjacent municipalities. Note: that Georgian Bluffs

residents spend only 2.4% of their after-tax household income to pay

their taxes. This likely explains why so many employees choose to

live in Georgian Blufs and Meaford and commute to their jobs in Owen

Sound - including city employees.

The result is very enlightening.

This disparity did not come about recently. It developed over the

past 30 years so as a result of two alarming trends;

1) the loss of high paying jobs, and

2) unnecessary expense increases at city hall.

Those of us who were around in the 60s and 70s remember that Owen

Sound once had a thriving industrial base. We can see some of the

remnants of these industries today in the abandoned properties, like

the empty lots where the Black Clawson Kennedy foundry once stood on

the west and Russel-Hipwell 's on the east side. There was also the

Keenan 's Toothpick factory, RCA, Goodyear and Pittsburg glass to

name just a few.

During the time when these jobs were disappearing Owen Sound 's

population was at times stagnant and often shrinking. One would

think that a shrinking population would result in city expenses at

least remaining the same. Yet when we examine city expenses during

this period and beyond we see that expenses were growing at times at

twice the rate of inflation. This link shows expense growth during a

ten year period. Expense Growth. Much of this expense growth was

caused by the city 's propensity to hire more staff in spite of a

stagnate population.

There is no question we are facing a crisis in housing and

homelessness throughout Ontario. Housing affordability is a reality

facing many families. Some are forced to rent inadequate

accommodations that just don 't meet their family needs while those

dreaming of home ownership are just priced out of the market.

Canadian Urban Institute 's report released in 2019 cited the housing

supply as the main cause of the housing crisis. This was echoed by

Ontario 's Affordability Task Force Report in 2022. However, in many

areas, Owen Sound for example, housing supply is not the only

driving force.

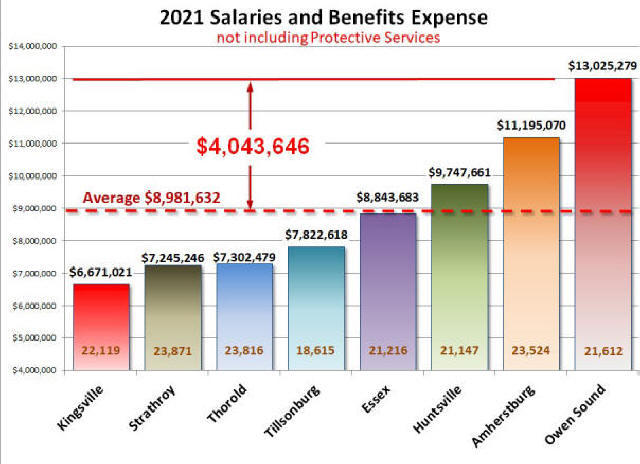

The average salary expense for these municipalities, excluding

protective services salaries, was about $9 million in 2021.

Huntsville, Amherstburg and Owen Sound all had a Salary Expense

greater than the average. Owen Sound spent $13 million on Salaries &

Benefits, excluding Protective Services salaries. To reduce Owen

Sound 's expense to the average of $9 million, an expense reduction

of $4 million would be required.

The only question that remains is; how did we get to our current

situation where our municipal workforce is grossly over staffed in

comparison to other similarly sized municipalities? My initial

belief was that this disparity was created by Councils over the past

20 years or so by approving excessively high annual increases in

expenses. However when I examined the changes in Salaries and

Benefits expenses over a ten year period for Owen Sound and two

other municipalities, I found that I was mistaken. Owen Sound 's

problem has existed for a much longer time period.

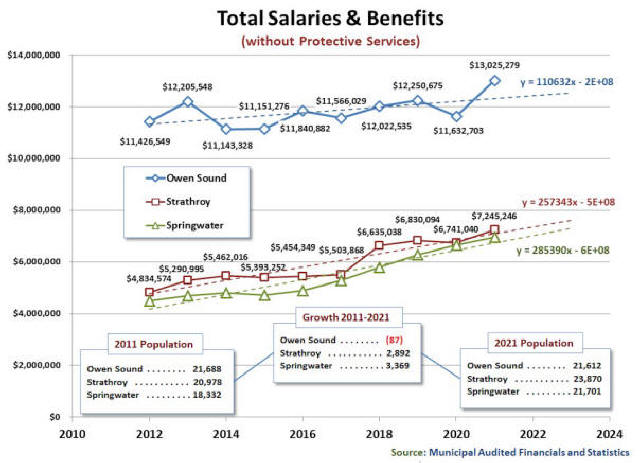

Owen Sound 's Salaries & Benefits expense in 2011 was more than twice

that of either Strathroy or Springwater as shown in the chart below.

By 2021 this difference had reduced somewhat. What this tells us is

that, although the Councils over the last ten years added to the

problem, they did not create the problem. This disparity likely

originated as much as 40 to 50 years ago and each Council over this

period added a little to the problem until we got to where we are

today. I suspect that each of these Councils failed to ask the

critical questions at budget time; such as, if our population is not

growing why do you need hire more staff to run the city?

As you can see from

the above, Owen Sound actually had 87 residents fewer residents in

2021 than it had in 2011. Yet, Owen Sound 's Salaries & Benefits

expense grew by $1.6 million. This suggests that there were at least

some additions to the workforce during this period. However, it 's

quite clear, a preponderance of the problem originated prior to

2011.

Prior to the 2023

budget I requested Council to address this problem in the 2023

budget.

As well I showed them that we needed a two-percent

tax reduction in order to close the tax-game with Georgian Bluffs.

My

2023 Service Review Paper. Unfortunately not one member of Council voted

to address this problem in the 2023 budget nor in any budget since

then.

If council were to

be persuaded to “right size” the city workforce so that the city 's

salaries and benefits expense matched the average of the eight

municipalities in the study group we would have $4 million in

surplus tax revenue each and every year. With this we could begin to

address the many Social problems we have in our community as well as

significantly reduce taxes for all residents. For example in the

past I advocated for the city to spend money on temporary winter

housing for the homeless. Some of this surplus could be used to

ensure warm winter housing for those in need each and every winter.

I now challenge all candidates for Council in 2026 to commit to

taking up this challenge. What Do You Think?

Figure 3;

Property Taxes as a

Percentage of After Tax

Household Income

source:

2022 BMA Report

The Solution -

to Ease the Pressure on Families

Figure 4;

Comparing Salary-Benefit Expense for

Similarily Sized

Municipalities Delivering Similar Services

Figure 5;

Historical Changes in Salaries & Benefits Expense for

Three Similarly Sized Municipalities